Section 179 Deduction Vehicle List 2024 – Below is our annual guide to Tax Code Section 179 vehicle from qualifying, so do your homework! IMPORTANT: This is the list of 2023 models that qualify, however, in 99% of the cases, the . you need to prorate the deduction. If you happened to purchase the vehicle in a prior year and want to claim the Section 179 deduction, unfortunately, that is not permissible. To qualify for the .

Section 179 Deduction Vehicle List 2024

Source : www.joerizzamaserati.com

Section 179 Deduction List for Vehicles in 2023 | Block Advisors

Source : www.blockadvisors.com

Section 179 Deduction Vehicle List 2023 Mercedes Benz of

Source : www.mercedesoflittleton.com

Section 179 Deduction List for Vehicles in 2023 | Block Advisors

Source : www.blockadvisors.com

Section 179 Tax Deduction for 2023 | Section179Org

Source : www.section179.org

Section 179 Deduction List for Vehicles in 2023 | Block Advisors

Source : www.blockadvisors.com

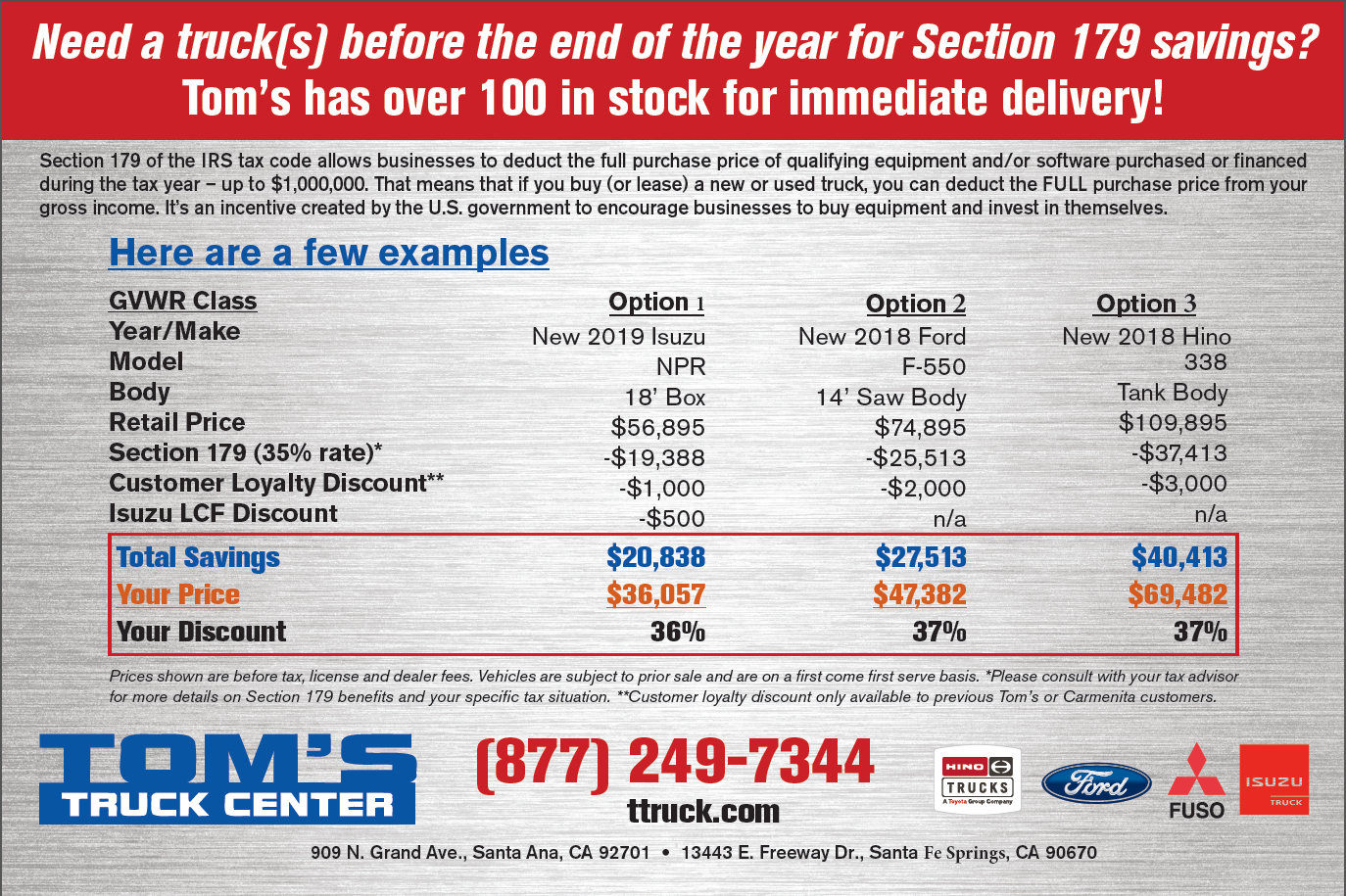

Section 179 Deductions! | Tom’s Truck Center

Source : www.ttruck.com

Section 179 Tax Exemption | Land Rover Anaheim Hills

Source : www.landroveranaheimhills.com

Section 179 Vehicle Tax Deduction | Bill Luke Chrysler Jeep Dodge Ram

Source : www.billluke.com

BEST Vehicle Tax Deduction 2023 (it’s not Section 179 Deduction

Source : www.youtube.com

Section 179 Deduction Vehicle List 2024 Maserati Section 179 Deduction for Vehicles | Joe Rizza Maserati: Section 179 is one of the more misunderstood parts of the US tax code. While many companies take advantage of the tax deduction for equipment purchases, a surprising number of US businesses do not. . Fewer reporting requirements, more deductions and tax breaks are included in the bill. Read on for more information about it. .